As trade tensions rise between the U.S. and China, rare earth minerals are once again in the political spotlight. Today Chinese mines and processing facilities provide most of the world's supply, and Chinese leader Xi Jinping has hinted about using this as political leverage in trade negotiations with U.S. President Donald Trump's administration. But in the long run, many experts say the global market involving these materials would likely survive even if China completely stopped exporting them.

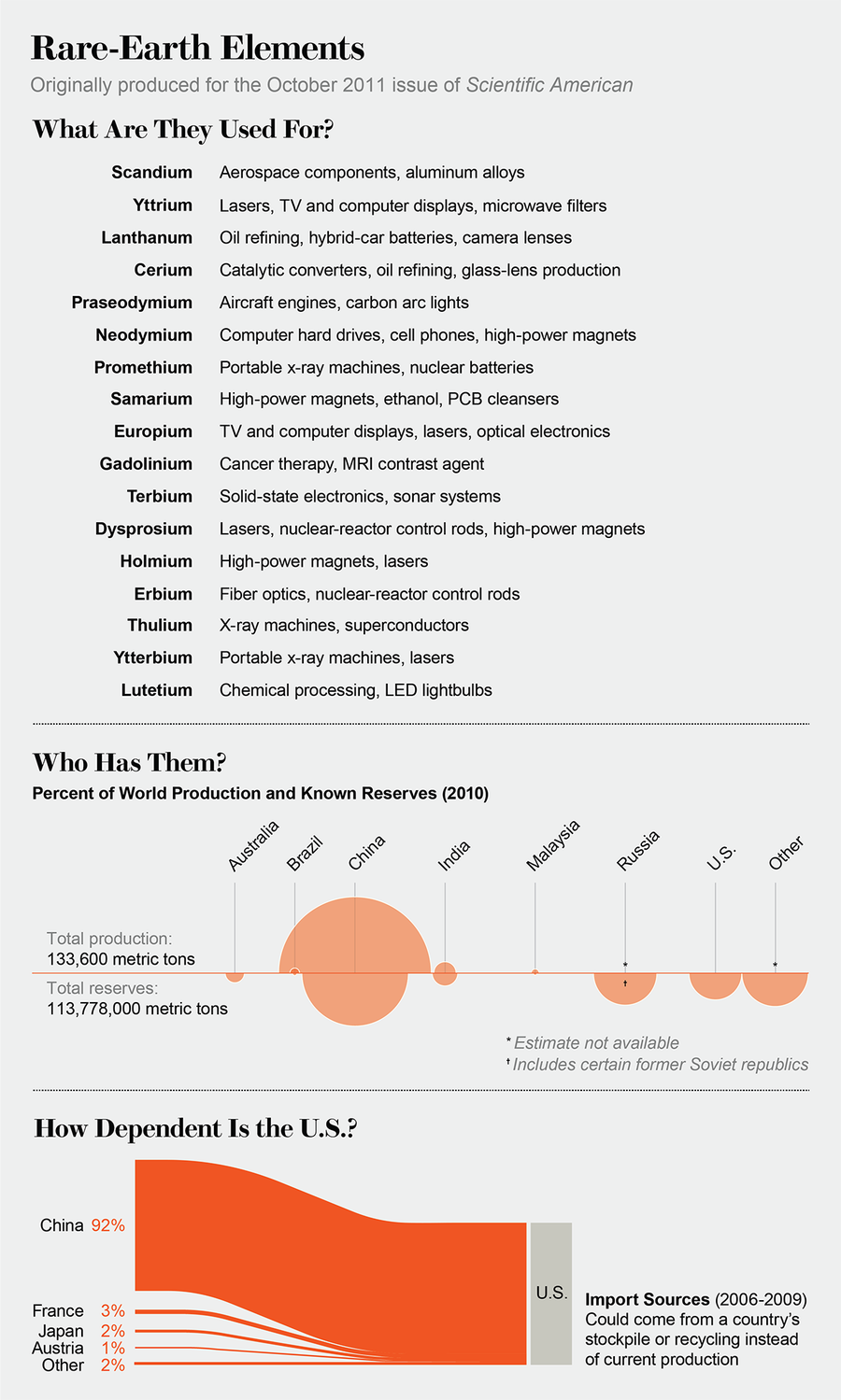

The 17 rare earth elements, which cluster near the bottom of the periodic table, play a vital role in several industries: consumer electronics including Apple AirPods and iPhones, green technologies such as General Electric wind turbines and Tesla electric cars, medical tools including Philips Healthcare scanners, and military hardware such as F-35 jet fighters. The U.S. government lists them among minerals deemed critical to the country's economic and national security, and the Trump administration notably exempted rare earth elements from tariffs it imposed on $300 billion worth of Chinese goods. On the other side of the trade conflict, Xi recently made a politically symbolic visit to one of China's main rare earth mining and processing facilities, and China used tariffs of its own to target a U.S. rare earth mine in California. Such political posturing on both sides, however, may overemphasize the world's reliance on China's supply of rare earth elements.

"Politicians get too alarmed or too wrapped up in the idea of political manipulation of markets," says Eugene Gholz, an associate professor of political science at the University of Notre Dame. "There's a big difference between individual companies making or losing money, and the large-scale ability to get political influence in this particular market."

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

The "rare" in the name of this group of elements is actually somewhat misleading; the U.S. Geological Survey describes them as "relatively abundant in the Earth's crust." But extraction is complicated by the fact that in the ground, such elements are jumbled together with many other minerals in different concentrations. The raw ores go through a first round of processing to produce concentrates, which head to another facility where high-purity rare earth elements are isolated. Such facilities perform complex chemical processes that most commonly involve a procedure called solvent extraction, in which the dissolved materials go through hundreds of liquid-containing chambers that separate individual elements or compounds—steps that may be repeated hundreds or even thousands of times. Once purified, they can be processed into oxides, phosphors, metals, alloys and magnets that take advantage of these elements' unique magnetic, luminescent or electrochemical properties. The strong and lightweight nature of rare earth magnets, metals and alloys have made them especially valuable in high-tech products.

Originally produced for the October 2011 issue of Scientific American. Credit: Jen Christiansen. Source: Mineral Commodity Summaries 2011, U.S. Department of the Interior and USGS

China currently has most of the world's separation facilities—but if it ever were to stop exporting the purified materials, other options exist. In the short term, U.S. companies that rely on these minerals would likely have inventory stockpiles for brief supply shortages, Gholz says, who served from 2010 to 2012 as senior advisor to the Pentagon's Deputy Assistant Secretary of Defense for Manufacturing and Industrial Base Policy. To stretch those stockpiles out, the overall market could prioritize rare earth elements for crucial applications such as military and medical technologies, while forcing makers of headphones or golf bags to pay more. "I don't think there is an obvious supply gap or hole where someone will not be able to get a Prius or Tesla or whatever they're looking at," Gholz says.

In the event of a longer Chinese supply interruption, the U.S. rare earths mine at Mountain Pass, Calif., would likely become the first place to step up production, Gholz explains. The mine's previous owner, Molycorp, spent approximately $1.5 billion building a new separation facility for producing rare earth concentrates. It did not, however, complete the downstream processing needed to produce purified rare earth materials before the company went bankrupt in 2015 because of Chinese competition. The mine's new owner, MP Materials, plans to reactivate and complete the mothballed facility for fresh operation starting in 2020.

Another alternative is Australian company Lynas Corp., the world's only significant rare earths producer outside China. It currently operates a mine at Mount Weld in Australia, and sends ores to a separation facility in Malaysia that can purify the rare earth materials—but a complication has arisen from the fact that some ores contain radioactive thorium. Environmental concerns about low-level radioactive waste from the separation facility recently led Lynas to announce it will move some some of the "upstream" processing (which involves the radioactivity) back to Australia, while keeping "downstream" processing in Malaysia. The company has also announced it will work with Texas-based Blue Line Corp. to build a new separation facility in the U.S. for operations starting in 2022 at the earliest.

Beyond existing mines, companies that dig for other resources might start extracting rare earth elements from deposits of different materials. For example, the U.S. could someday obtain these elements as byproducts from power plant coal ash and coal mining waste. And radioactive material mixed in with ores could end up being positive: If thorium-based nuclear plants prove viable, expanded thorium mining would also turn up usable rare earth minerals. Researchers have even begun investigating a large concentration of rare earth elements in deep-sea mud from an ocean floor deposit near Japan.

Less Is More

Some industries that rely on rare earth elements are going outside the box and looking for ways to bypass mining entirely. After all, such operations in China and elsewhere have significant environmental impacts that can threaten human health in the absence of strict regulation. The presence of radioactive thorium in some ore is one example. In addition, some mining and separation processes involve chemicals that produce toxic wastewater. All of these dangerous byproducts require scrupulous storage and disposal.

With China threatening to weaponize its advantage when it comes to rare earth elements, more companies may invest in innovations that could replace these materials with something else. Gholz points to a 2010 incident in which China temporarily cut off Japan from its supply of rare earth elements. Afterward, Japanese automakers such as Toyota and Honda began developing hybrid car motors that greatly reduced or even eliminated rare earth elements, such as terbium and dysprosium, from the powerful magnets used in electric motors.

During the 2010 supply scare, other large industries that used rare earth elements also discovered they could do without some of them. Oil refinery operators temporarily stopped using the rare earth element lanthanum, which improves oil refining efficiency, when the price went up. The glassmaking industry largely abandoned using the rare earth element cerium for polishing. Although industries related to national security would be unable to entirely forgo rare earth minerals, Gholz thinks the U.S. military's demand could be "easily satisfied by non-Chinese production" because this need represents less than 5 percent of the total market.

Reduce, Reuse, Recycle

In any case, a variety of industries will continue to rely heavily on rare earth minerals. To obtain them without depending on Chinese or U.S. mines, they could recycle those elements already used in products, says Eric Schelter, a professor of chemistry at the University of Pennsylvania, whose research projects include developing new chemical processes for separating rare earth elements from ore. "The appeal here is that there has already been a significant energy input and waste output to purify rare earth elements from their ore materials," he says. "Simply throwing them away is therefore wasteful, considering that in technological devices, they are typically relatively pure compared to their ores."

He pointed to many research projects at both academic and government labs: the latter include the U.S. Department of Energy's Critical Materials Institute at the Ames Laboratory and the Oak Ridge National Laboratory. For example, rare earth elements such as neodymium and dysprosium are frequently combined in permanent magnets. To separate them, Schelter's lab has developed chemical processes that can selectively dissolve one rare earth element while the other remains solid. It's a "fast and efficient approach to metals separation," he says, but the cost is currently not competitive with mining. Still, he thinks that could change because the market price of rare earth elements is currently kept "artificially low"—it does not account for the cost of waste treatment and handling during the mining and separation processes. If the recycled versions of these materials were marketed as cleaner alternatives to mined rare earth elements, it might encourage companies seeking a greener image to pay more for them.

"Consumers recognize the importance of free trade coffee and consequences of blood diamonds," Schelter says. "It stands to reason that ethical cobalt and clean or recycled rare earth elements can contribute to a more sustainable picture for this industry."