Israel is heading for the moon—and a lunar milestone. If all goes well, a lander scheduled to launch on 21 February will become the first privately funded craft to land on the moon. The feat seems set to kick off a new era of lunar exploration—one in which national space agencies work alongside private industries to investigate and exploit the moon and its resources.

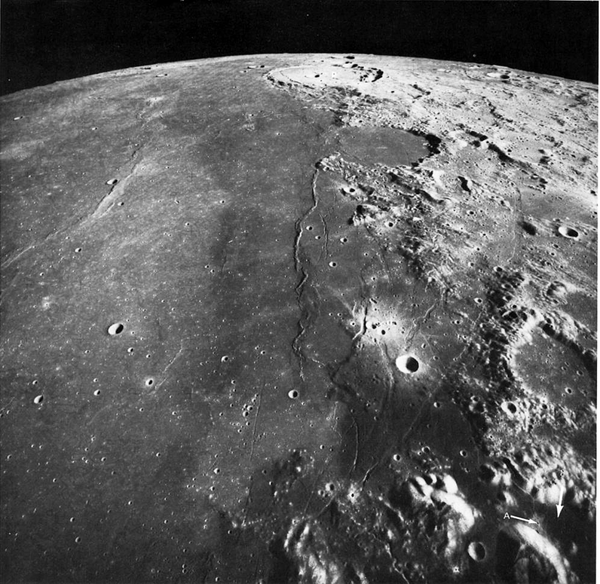

The craft, named Beresheet—‘in the beginning’ in Hebrew—was built by an Israeli non-profit company called SpaceIL that raised US$100 million for its mission, much of it through philanthropic donations. Beresheet will lift off on a SpaceX Falcon 9 rocket from Cape Canaveral, Florida, and should reach Mare Serenitatis, a basaltic plain on the northern hemisphere of the moon, in April (see ‘Moon shot’). There, it will study the presence of magnetism in lunar rocks, a phenomenon that is puzzling given the satellite’s lack of a global magnetic field (see ‘What will Beresheet do on the Moon?’).

The mission is not wholly private, because it involves government partners. And although the craft is little more than a demonstrator—its scientific mission is simple and the lander is expected to last just two days on the surface—the mission is symbolically important. It would be Israel’s first moon mission, as well as the first privately backed craft to ‘soft land’ on the moon’s surface—until now, the preserve of an elite club of the national space agencies of the United States, China and Russia.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

SpaceIL’s success would be an important milestone, says Robert Böhme, chief executive and founder of PTScientists in Berlin, a private company also shooting for the moon. “It would be a big proving point, because right now the only one with soft landing capability is China,” he says.

The Israeli success could herald a crop new of landers and flip the business model for lunar exploration to one in which private firms essentially sell a delivery service. Customers could buy space on landers to ferry their cargo—from scientific instruments built by space agencies and universities to telecommunications firms’ technology and urns from companies promising to put loved ones’ ashes on the moon. In the long term, firms might want to go to the moon to mine for water, which could be turned into fuel to power rockets or sustain a lunar settlement.

Lunar scientists are also set to benefit from a commercial fleet of landers. Aside from China’s Chang’e-4 craft — which landed last monthand is the moon’s only active robotic resident—the last surface missions were in the late 1970s, says Barbara Cohen, a planetary scientist at NASA’s Goddard Space Flight Center in Greenbelt, Maryland. “This generation of lunar scientists hasn’t been able to do anything robotically,” she says. “We’re really excited.”

XPRIZE legacy

SpaceIL will be the first former competitor for the now-defunct Google Lunar XPRIZE to launch its mission to the moon. But at least five companies that competed for the prize plan to launch missions by the end of 2021. All are vying to be the first fully commercial mission to make it (see ‘Commercial players’).

The Google Lunar XPRIZE deserves credit for the moon’s popularity today, says Bob Richards, chief executive of Moon Express in Cape Canaveral, another former competitor. The ambitious project launched in 2007 to spur affordable and commercial access to the moon. It offered $20 million to the first team to land a craft on the surface and perform basic tasks. The competition was cancelled in January 2018 when none of the entrants looked set to meet the March launch deadline. At the time, the XPRIZE Foundation in Culver City, California, put the failure down to teams’ difficulties in raising funding, as well as technical and regulatory challenges.

The landscape for private moon landers has changed dramatically since then—thanks to falling launch costs, a growing pool of customers willing to pay for a trip to the moon and fresh government backing for such efforts, say firms.

SpaceIL’s lead in this new space race is largely down to its funding, says Richards.

Three young engineers founded the firm in Tel Aviv in 2011, but it has drawn cash injections totalling $43 million from Morris Kahn, a South African telecommunications billionaire who is now the firm’s president. The mission has become a national project, involving the Israel Space Agency—which chipped in $2 million—and Israel Aerospace Industries in Lod, the country’s major aerospace and satellite firm, which built the craft. The project has also kept costs down by hitching a ride on the Falcon 9 along with other cargo: an Indonesian satellite and, reports suggest, a small satellite for the US Air Force.

Government backing

Growing interest from governments that are keen to get back to the moon is also spurring the new lunar business model.

NASA and the European Space Agency (ESA) are looking to fund private firms to ship scientific instruments to the lunar surface, in the hope that the agencies will eventually be among many customers using the service.

NASA turned its sights back to the moon after a U.S. presidential directive in 2017. The agency’s aim is to provide a training ground for Mars missions and to study lunar resources that could sustain a human presence on the moon, for example by mining oxygen and hydrogen for fuel, as well as purely scientific studies.

To help reach these goals, the agency launched the $2.6-billion, 10-year Commercial Lunar Payload Services (CLPS) programme in 2018. In November, NASA picked nine consortia that it has deemed eligible to fly its payloads to the moon. Each is led by a US firm and includes multiple partners to cover launch, lander and operations capabilities. Scientists have until 27 February to submit proposals to NASA for instruments or technologies that could make up the raft of payloads to be shipped commercially.

The programme is intended to “jump start” a new private moon lander industry, says Richards, and mirrors NASA’s effort more than a decade ago to encourage development of commercial spaceflight firms such as SpaceX. The agency is now among many clients that use these commercial services to send cargo to space.

Railway to the moon

Böhme says that NASA is likely to pick dozens of payloads as part of the CLPS programme, giving several firms a shot at the moon, probably from 2020. “We’re creating the railroad, a DHL delivery service to the moon,” says John Thornton, chief executive of Astrobotic, based in Pittsburgh, Pennsylvania, another firm hoping to land the first commercial lunar craft.

For scientists, the model has pros and cons, says Cohen. At first, landers wouldn’t be sophisticated and would not have scoops or drills to collect samples, or be able to survive the cold lunar night. And scientists wouldn’t necessarily have access to the craft’s ‘housekeeping’ data, which can be useful for calibration. But the “big, big plus” is that the sheer number of opportunities to land on the moon will allow a wider range of researchers to get involved and carry out riskier projects, she says.

Many former XPRIZE firms from around the world are part of teams eligible to bid for contracts under the CLPS, although a number are also planning independent launches outside the programme (see ‘Commercial players’). These include Tokyo-based start-up ispace and TeamIndus in Bengaluru, India, which scrapped a planned launch in 2018. TeamIndus aims to launch missions to the moon “multiple times” over the next three to five years, says Sheelika Ravishankar, who heads outreach for the firm. (The Indian Space Research Organisation also hopes to make its first controlled landing on the moon this year, with its Chandrayaan-2 mission.)

European vision

ESA started eyeing a return to the moon before NASA, and also hopes to boost the fortunes of fledgling space companies.

The agency is planning a single lander mission that would launch in 2025, aimed at demonstrating the feasibility of harvesting water or oxygen from soil at the lunar poles.

Last month, ESA contracted PTScientists (which was created in direct response to the XPRIZE), rocket-makers ArianeGroup of Paris and aerospace firm Space Application Services of Brussels to explore the viability of such a mission.

Böhme says that the agency hopes to secure the roughly €250 million (US$283 million) it would need from member states in November—something that he is confident will happen because of international momentum in lunar exploration, and the relatively small mission size.

Unlike in the CLPS programme, for which commercial partners will cover launch costs, ESA would pay for the mission’s launch and operations, as well as space on the lander, says Böhme. Operations would cost around €130 million, he says, and the remaining €120 million would pay for the development of scientific payloads. But these payloads would take up only half of the lander’s capacity, so PTScientists could sell the rest of the space to other customers—for profit. “It’s a nice business case to have,” says Böhme.

Reality check

Today, Richards estimates that a mission to the moon’s surface could cost about $50 million, half of what it cost a decade ago. Economies of scale for subsequent missions could bring the price of individual payloads down to just hundreds of thousands of dollars, he says.

But despite companies’ success in raising investment and securing customers, some experts remain sceptical that in the long term there will be many takers beyond the space agencies.

For instance, it’s not clear whether there are customers—apart from governments—who would want moon-derived rocket fuel. The only profitable use might be to power travel farther into the Solar System—for example, to mine asteroids, says Jonathan McDowell, a space historian and astronomer at the Harvard–Smithsonian Center for Astrophysics in Cambridge, Massachusetts. That might be decades away.

“What are they going to get—anything other than advertising? That’s the missing piece of this I can’t quite get my brain around,” says McDowell.

This article is reproduced with permission and was first published on February 20, 2019.